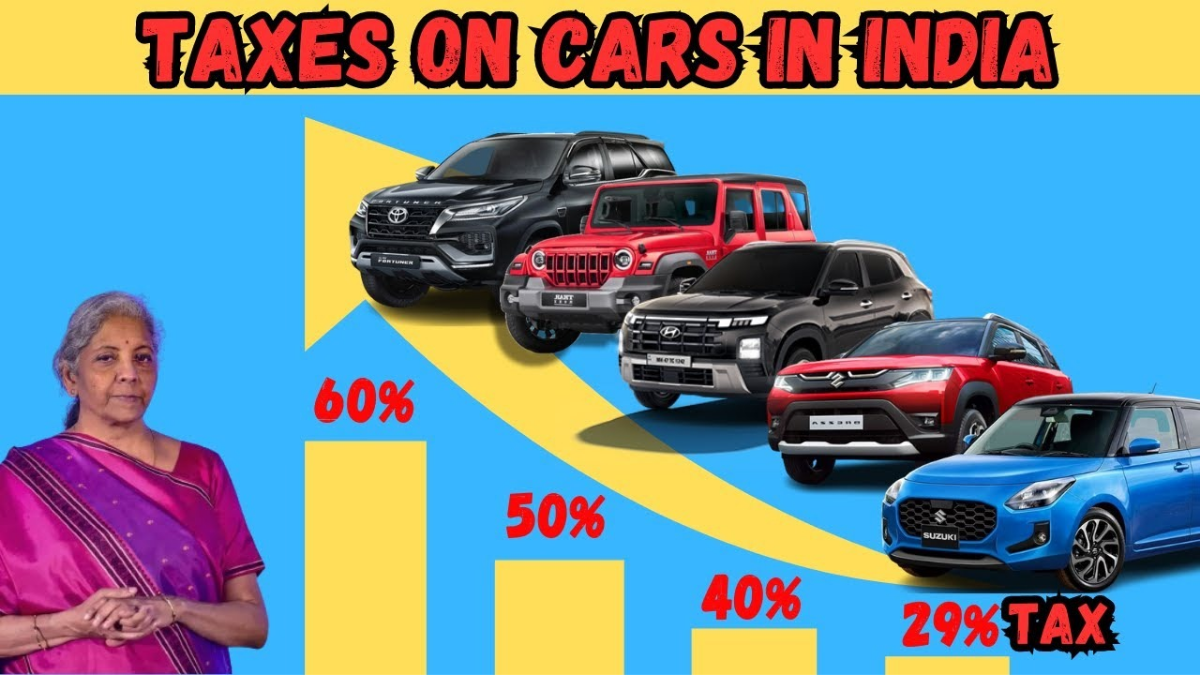

New Tax Rules for Cars, Bikes, and Tractors in India – The Indian government has introduced GST 2.0, a new tax system that will change the price of cars, bikes, tractors, and other vehicles. These new rules will start from 22nd September 2025, just before the festive season.

Earlier, vehicles had GST plus extra cess, which made the tax system complicated. Now under GST 2.0, the tax system has been made simple with only two main tax slabs – 5% and 18%, and a 40% tax slab for luxury and big vehicles.

This new system will make common vehicles cheaper and easier to buy, while luxury and big bikes will remain costly.

IN THIS ARTICLE

Which Vehicles Will Become Cheaper?

The government has given relief to small cars, normal bikes, tractors, three-wheelers, and commercial vehicles.

- Small Cars (Under 4 metres)

Cars with petrol, CNG, or LPG engine up to 1200cc and diesel engine up to 1500cc will now have 18% GST. Earlier they had to pay 28–31% tax.

This means hatchback and small sedan cars will now be 12–13% cheaper. - Two-Wheelers (Up to 350cc)

Scooters and bikes with engine up to 350cc will now have 18% GST instead of 28%.

This is a big benefit for students, office-goers, and middle-class families. - Tractors (Up to 1800cc)

GST on tractors has been reduced from 12% to only 5%.

This will help farmers because tractors will become cheaper and easier to buy. - Three-Wheelers (Passenger and Cargo)

All three-wheelers will now have 18% GST instead of 28%.

This will help auto-rickshaw drivers, small traders, and transport providers. - Electric Vehicles (EVs)

Tax on EVs will remain 5%, the same as before.

This shows the government wants to encourage people to buy more electric cars and bikes.

Source: GaadiWaadi

Which Vehicles Will Become Costly?

Some categories will now face higher taxes.

- Luxury Cars and SUVs (Above 1500cc or longer than 4 metres)

These vehicles will now have 40% GST. Earlier, the rate was around 48–50% including cess. Even though the cess is removed, these cars will still remain costly compared to small cars. - Big Bikes (Above 350cc)

Bikes with engine above 350cc, like superbikes and cruisers, will now have 40% GST instead of 31%.

This means premium bikes will become more expensive.

Why GST 2.0 Is Important?

1. Simple System

Earlier, the tax system had many slabs and cess, which was confusing. Now it is clear – only 5%, 18%, or 40%.

2. Cheaper Vehicles for Common People

Small cars, scooters, bikes, and three-wheelers will become cheaper. This will help families, students, farmers, and small traders.

3. Boost to Auto Sales

The auto industry will benefit because cheaper vehicles mean more people will buy during the festive season.

4. Support to Farmers and Small Businesses

By reducing tax on tractors and three-wheelers, the government has given direct help to farmers and local business owners.

5. Push for Electric Mobility

By keeping GST at 5% on EVs, the government is promoting clean and green transport.

New Tax Rules for Cars, Bikes, and Tractors in India – Before vs After

| Vehicle Type | Old Tax Rate | New GST Rate | Effect |

|---|---|---|---|

| Tractors (Up to 1800cc) | 12% | 5% | Cheaper |

| Small Cars (Petrol ≤1200cc, Diesel ≤1500cc, ≤4m) | 28–31% | 18% | Cheaper by 12–13% |

| Cars Up to 1500cc | 45% | 40% | Slightly cheaper |

| Cars Above 1500cc & 4m | 48% | 40% | Still costly |

| Electric Vehicles (EVs) | 5% | 5% | No change |

| Three-Wheelers | 28% | 18% | Cheaper |

| Bikes Under 350cc | 28% | 18% | Cheaper |

| Bikes Above 350cc | 31% | 40% | Costlier |

Conclusion

The new GST 2.0 system is a big change for India. For the common man, vehicles like small cars, two-wheelers, tractors, and three-wheelers will become cheaper. This will help more families buy their first car or bike, farmers to buy tractors, and traders to run their business.

On the other side, luxury cars and big bikes will remain costly because of the higher 40% GST.

56th GST Council Meeting 2025 – Key Highlights, Agenda, and Impact

BHEL Secures ₹2600 Crore Order for 800 MW Anuppur Thermal Power Project in MP